How Businesses Can Use IRA Incentives to Pay for Solar Panels

Nov. 07, 2023

Is your business thinking about going solar? There’s never been a better time. Commercial solar panels are currently more affordable than ever thanks to new commercial solar incentives and tax credits introduced by the Inflation Reduction Act (IRA).

Keep reading to learn more about the Inflation Reduction Act’s solar provisions and how your business can use solar incentives to help pay for a commercial solar panel installation.

The Solar Tax Credit Reduces Installation Costs by 30% or More

The federal government offers a substantial tax credit to businesses that install commercial solar panels. The solar credit for businesses is worth 30% or more of your total solar installation costs, significantly reducing your upfront investment and making it easier to fund a commercial solar panel installation.

Your installation costs play a significant role in how quickly you break even on solar panels—the less you pay, the sooner you can break even. Since the tax credit covers a significant portion of your installation costs, it will speed up your break-even point so you can start making money on your investment faster.

Bonus Tax Credits for Commercial Solar Installation

There are three bonus tax credits available for commercial solar panel installations that can be claimed on top of the 30% federal solar tax credit:

- Domestic Content Bonus: Projects that meet domestic content minimums are eligible for a 10 percentage point increase in value of the solar tax credit.

- Energy Community Bonus: Projects located in an energy community are eligible for a 10 percentage point increase in the value of the solar tax credit.

- Low-Income Bonus: Projects located in a qualifying low-income community are eligible for a 10 percentage point increase in the value of the solar tax credit. Projects classified as a “qualified low-income residential building project” or “qualified low-income economic benefit project” are eligible for a 20 percentage point increase in the value of the solar tax credit.

Learn more about the bonus credits and their eligibility requirements.

Recover Costs Faster MACRS Depreciation for Solar

The Modified Accelerated Cost Recovery System (MACRS) is a depreciation system used in the United States to help businesses recover the cost of certain assets via annual deductions. Commercial solar energy systems are eligible for a recovery period of five years.

Businesses can take advantage of the 30% solar tax credit and MACRS depreciation for the same project. However, for equipment on which the solar tax credit is claimed, the project’s depreciable basis must be reduced by half the value of the solar tax credit. So, if you claim the 30% tax credit, your project’s depreciable basis is reduced by 15% (half of the 30% tax credit value), and your business is able to deduct 85% of its tax basis.

Talk to an Expert About Commercial Solar Tax Incentives

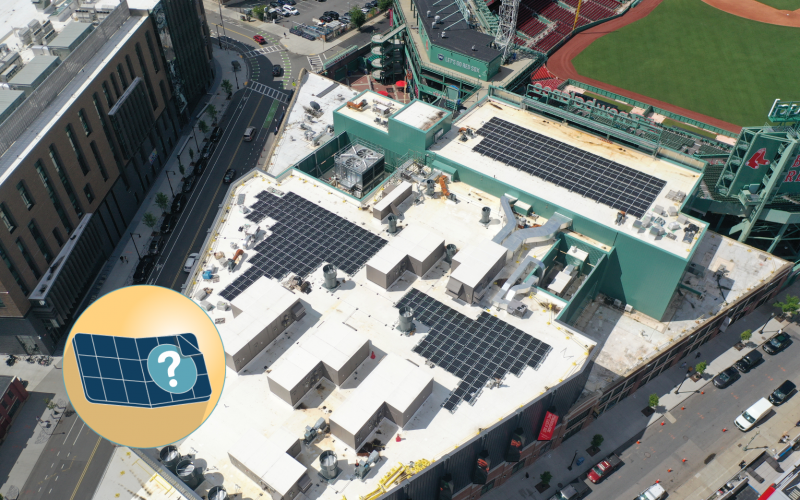

Boston Solar is the leading commercial solar installer in New England with over a decade of experience and 5,000+ solar installations under our belt. We’ve installed commercial solar arrays for businesses of all sizes, and we’re a Proud Partner of the Boston Red Sox. If you have questions about commercial solar panels and tax incentives, just give us a call. We are here to help you get the most out of your investment in solar panels, starting with the best incentive package possible.

Don’t miss out on commercial solar incentives! Call 617-858-1645 or contact us to learn more.